Understanding the role that Managed Service Providers and IT Security Consultants play when moving forward with supporting organizations subject to the FTC guidelines. These include industry verticals like Accounting Firms or Auto Dealerships for example.

The Federal Trade Commission (FTC) has recently released new rules for safeguarding consumer information, known as the Safeguards Rule. These rules, which are part of the Gramm-Leach-Bliley Act (GLBA), require financial institutions to have measures in place to protect the personal information of their customers. This includes information such as social security numbers, financial account numbers, and other sensitive data.

As an accounting firm, it is important to understand the requirements of the Safeguards Rule and take the necessary steps to ensure compliance. This includes developing a written information security program (WISP) that outlines the measures your firm will take to protect consumer information. The WISP should include policies and procedures for accessing, using, and disclosing customer information, as well as measures to prevent unauthorized access or use of that information.

Some of the key requirements of the Safeguards Rule include:

Conducting regular risk assessments to identify potential vulnerabilities in your firm’s information security program

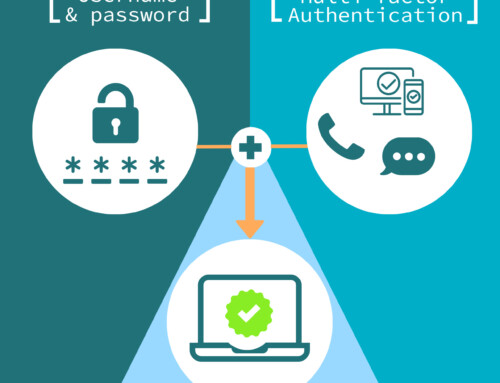

Implementing appropriate controls to protect against those risks, such as encryption, firewalls, and intrusion detection systems

Training employees on the proper handling of customer information and the importance of keeping that information secure

Regularly monitoring and testing the effectiveness of your information security program

By taking these steps, accounting firms can ensure that they are in compliance with the Safeguards Rule and that customer information is protected from unauthorized access or use. It is essential to stay informed about the latest regulatory requirements and best practices for information security, to ensure that your firm is able to provide a high level of service and support for your customers.

In conclusion, accounting firms must understand the FTC’s Safeguard rules and take the necessary steps to protect consumer information. The new rules require financial institutions to have measures in place to protect the personal information of their customers, including developing a written information security program (WISP) that outlines the measures your firm will take to protect consumer information. It is vital to stay informed about the latest regulatory requirements and best practices for information security, to ensure that your firm is able to provide a high level of service and support for your customers.